The HSBC Flash China Manufaturing PMI is compiled by market with HSBC. Underlying data is available for market subscribers. Contact: economics@markit.com

HSBC on the Internet is located at: www.hsbc.com.cn

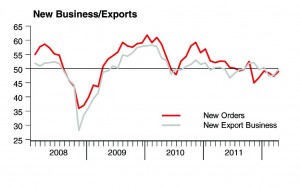

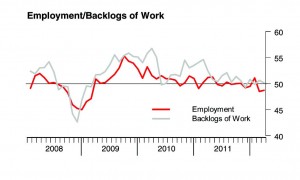

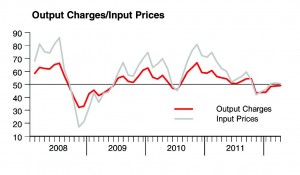

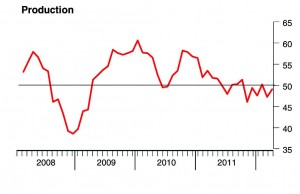

HSBC’s Flash China Manufacturing Purchasing Managers’ Index survey shows flat to negative growth for March and April. According to Hongbin Qu, Chief Economist, China (and co head of Asian economic research at HSBC), “as the April flash PMI ticked higher, this suggests that the earlier easing measures have started to work and hence should ease concerns of a sharp growth slowdown. That said, the pace of both output and demand growth remains at a low level in a historical context and the job market is under pressure this calls for additional easing measures in the coming months. We expect monetary and fiscal easing to speed up in Q2”.

What does this mean? In essence, the Chinese government will throw money at the growth problem, much as Europe had planned to address stalled growth on that continern. Can the U.S. resist a third round of quantitative easing when her major trading partners are pumping liquidity into the global banking system?