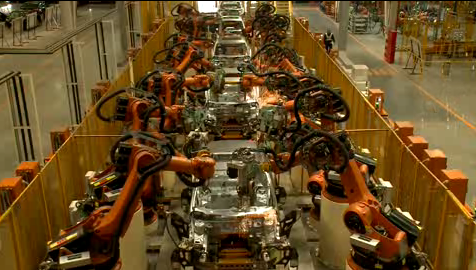

Work takes place at Fords plant in Chonqing, China. (Image: Ford)

SEOUL, South Korea — Asian stocks were mostly higher Tuesday after a second Chinese manufacturing survey suggested the slowdown in the worlds No. 2 economy is stabilizing.

Japans Nikkei 225, the regional heavyweight, rose 0.9 per cent to 15,068.12. Japanese shares have been boosted recently by renewed weakness in the yen and expectations the countrys giant government pension fund will increase its holdings of shares at the expense of bonds.

Hong Kongs Hang Seng added 0.8 per cent to 23,254.94. Stocks in mainland China, Taiwan and the Philippines also gained.

South Koreas Kospi erased earlier losses and inched up 0.1 per cent to 2,003.55. Samsung Electronics Co. rose 1 per cent after Samsung Everland Inc., which serves as a holding company for the Samsung Group, said it would seek an initial public offering by early next year.

Australias S&P/ASX 200 dropped 0.5 per cent to 5,490.50.

Investor sentiment was boosted by a survey of Chinas factories that showed a contraction in manufacturing was easing.

The HSBC index, which is based on a survey of factory purchasing managers, climbed to 49.4 last month from 48.1 in April. The index uses a 100-point scale on which numbers above 50 indicate expansion. The number was weaker than 49.7 in a preliminary version of the survey because of a revision to stocks of finished goods.

On the weekend, the China Federation of Logistics and Purchasing said Chinese manufacturing grew for the third consecutive month in May. Its survey focuses on state owned companies while the HSBC survey is weighted to private businesses.

U.S. stocks climbed Monday after a revised U.S. manufacturing report showed U.S. manufacturing industries expanded in May. The Institute for Supply management corrected its earlier statement that U.S. manufacturing slowed last month.

The Dow closed up 0.2 per cent to 16,743.63 and the Standard & Poors 500 added 0.1 per cent to 1,924.97, setting a record high for a second trading day in a row. But the Nasdaq composite finished 0.1 per cent lower at 4,237.20.

Later this week, key events for investors will include the European Central Bank policy meeting on Thursday. Analysts said the bank will likely introduce additional stimulus measures after weak manufacturing in Europe and subdued inflation in Germany.

In the U.S., Mays employment report will be released on Friday. Economists expect the U.S. economy created 220,000 jobs in May, and the unemployment rate fell to 6.3 per cent, according to FactSet, a financial information provider.

In energy markets, benchmark U.S. oil for July delivery was up 9 cents to $102.56 a barrel in electronic trading on the New York Mercantile Exchange. The contract fell 24 cents to $102.47 on Monday.

In currencies, the euro rose to $1.3605 from $1.3598. The dollar fell to 102.35 yen from 102.41 yen.