Canadian metalworking does extensive research on businesses across Canada in an ongoing effort to measure and understand the economics and importance of our sector. The charts and graphs make for interesting reading and reveal some interesting facts about the industry as we fight our way out of global recession.

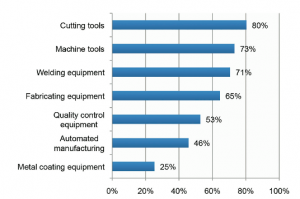

Products in active use:

(click to enlarge)

This graph shows current product types in active use, meaning equipment used for moneymaking activities on the shop floor. At 80 per cent and 73 per cent respectively, cutting tools and machine tools are, not surprisingly, the majority of the production base in Canada, followed by welding and fabricating equipment. The interesting stat is quality control equipment, at 53 per cent. This figure is far lower than the machine tool stat, suggesting that modern automated or semi-automated quality assurance technology isn’t fully utilized in Canada’s shops. Similarly, automated manufacturing lags, reflecting the gap between high-volume large producers and job shops in Canada. The low penetration of metal coating equipment is no surprise. Tough environmental regulations make the traditional paint booth or pickling tank an expensive proposition, leaving high value finishing to specialist companies.

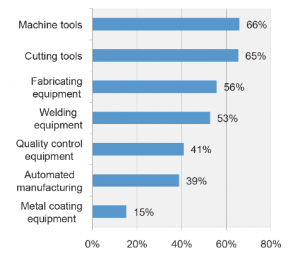

Involvement in the purchase of product types:

(click to enlarge)

Compared to the product types in the active use chart, reader involvement in equipment purchase is notably lower. Most involved are machine and cutting tools, reflecting the increasing complexity of the equipment and the need to consult more players on both shop floor and front office to make a sensible decision. Fabricating and welding involve fewer individuals, reflecting the specialist nature of the machines; Canadian shops, with a few exceptions, spend more time and effort shopping a multi-axis mill than a TIG welder, although both are important to productivity. Quality and automation spending is a surprise at 41 and 39 per cent. Both figures suggest low penetration rates for the products in Canadian shops, but also imply that fewer personnel are involved in these important equipment buys. One possible reason is the reliance on vendor support for complex machinery buys…or an underestimation of the importance of quality and automation.

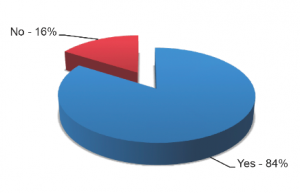

Involvement in the buying decision:

(click to enlarge)

This simple chart makes an interesting point. It shows 84 per cent of shop personnel are involved in the specification or purchase decision process for new tools and equipment. This figure would seem to contradict the previous chart, which shows lower direct involvement by equipment type. There are two plausible reasons for the discrepancy. One is that Canadian shops have become much more specialized, with staff highly skilled at a few tasks, splitting the purchase decision into separate teams. The other possibility is that much of the decision making process is happening in the front office, wher key players may be involved in the purchase decision without knowing or understanding exactly what the equipment does. This makes sense in medium to large operations, wher return on investment, financing and logistics are handled by specialists; they simply don’t need to know exactly what the equipment does, as long as it’s specified correctly.

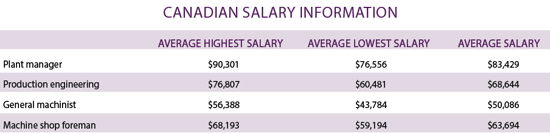

Salary information for Canadian shop employees:

The bottom line is money and this chart shows wher we stand as an industry. There are two key points illustrated by this simple chart. The first is, there is very little variation between highest and lowest average salary in each job classification. This suggests an increasing professionalism (and credentialism) as job categories are more often filled by workers with specific training and qualifications. This standardization extends from the general machinist to the plant manager…the days of working up from the floor without formal training are clearly over. The other, most important point is that this is a well-paid industry. According to the most recent Statistics Canada figures (2010) the national average income for men is $46,500 and for women $31,700, and averages in each category exceed those figures. The low participation rate of women on the shop floor in the Canadian metalworking industry makes gender comparisons difficult in our sector. In every case, however, the most important statistic, income, suggests that this should be an attractive industry for youth, with an excellent future.